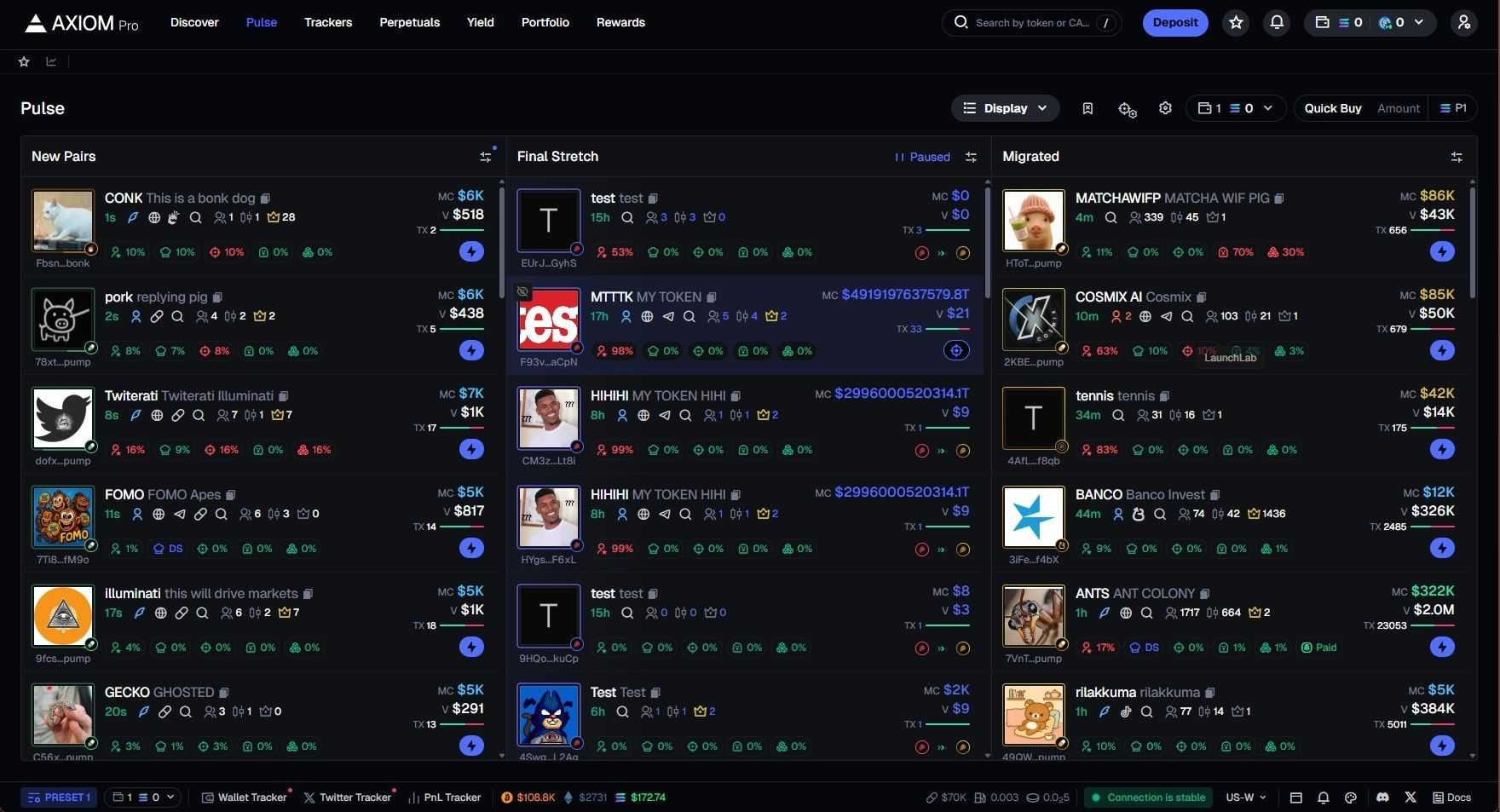

🔍 Overview: What Is Axiom.trade?

Axiom.trade is a web-based decentralized trading terminal built specifically for memecoin traders and Solana ecosystem participants. Launched in 2024, the platform has received attention for its blazing-fast trading interface, real-time memecoin scanners, and perpetual futures support — all packaged in a non-custodial, privacy-friendly structure.

Notably, Axiom.trade was selected for Y Combinator Winter 2025, giving it a credibility boost within the crypto startup ecosystem.

But despite its innovation, there are serious concerns — including reports of frozen funds, lack of regulation, and confusing fee structures.

⚠️ Disclaimer

Trading memecoins and leveraged crypto assets involves high risk and is not suitable for all investors. Axiom.trade is an unregulated, non-custodial platform — use at your own discretion. Always do your own research, start small, and never trade money you can’t afford to lose.

🚀 Key Features of Axiom.trade

⚡ 1. Ultra-Fast Execution

Trades are executed on-chain, often within a single block. This makes it ideal for sniping newly launched Solana memecoins.

-

“Turbo Mode” for minimal slippage

-

On-chain aggregation from Raydium, Jup.ag, Pump.fun, etc.

👉 Join Axiom.trade now and unlock high-speed, on-chain trading — no KYC required.

🧠 2. Smart Token Discovery Tools

The platform includes a toolset geared for finding and front-running trending coins:

-

Pulse: Tracks top holders, smart money wallets, volume surges

-

Social & Wallet Tracking: Combines Twitter + on-chain activity to signal pump potential

-

Launch Filters: Time since creation, LP locked/unlocked, honeypot detection

💱 3. Spot & Perpetual Trading

-

Spot trading is enabled via Solana token pairs

-

Perpetual Futures available via integration with Hyperliquid

-

Up to 50x leverage, collateral in USDC

🔐 4. No KYC, Non-Custodial

-

You keep your crypto in your wallet until execution

-

Withdrawals are processed on-chain

-

Optional integration with Coinbase Pay (up to $500/week without KYC)👉 Join Axiom.trade now and unlock high-speed, on-chain trading — no KYC required.

📊 Fee Structure

Axiom uses a tiered fee model:

| Tier | Trading Fee | Cashback |

|---|---|---|

| Wood | 1.00% | 0.05% |

| Bronze | 0.95% | 0.10% |

| Diamond | 0.80% | 0.25% |

| Champion | 0.75% | 0.30% |

🔍 Note: Small traders report that fees can outweigh profits on low-cap tokens or sub-$50 positions due to flat percentage models.

💬 Real User Feedback: Praise & Complaints

✅ What Users Like

-

Blazing fast execution during memecoin pumps

-

No need to use multiple dApps to snipe or track launches

-

No KYC, full control over funds

-

Clean, pro-level trading UI

❌ What Users Complain About

-

Trustpilot score ~2.7/5 with reports of:

-

Withdrawal freezes

-

Unexpected account closures

-

No customer support responses

-

-

Reddit posts highlight:

-

Fee confusion and hidden cuts on trades

-

Poor slippage handling during high volatility

-

Inconsistent performance of Pulse scanner

-

⚠️ Red Flag: Some users claim their funds were frozen after achieving large gains — and that support became unresponsive or requested late-stage KYC despite initial anonymity.

⚖️ Pros & Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Real-time execution on Solana | Not regulated by any Tier-1 financial authority |

| Advanced memecoin trading tools | Mixed user reviews (Trustpilot, Reddit) |

| Supports spot & perps in one platform | Fee structure penalizes small traders |

| Non-custodial with no forced KYC | Reported withdrawal issues / frozen funds |

| Backed by Y Combinator, strong tech team | No live support or known dispute resolution path |

🧠 Who Should Use Axiom.trade?

Axiom.trade is built for experienced, high-risk crypto traders, specifically:

-

Memecoin scalpers on Solana

-

High-frequency traders using on-chain tools

-

Users who prioritize speed, privacy, and wallet control

This is not for beginners, casual traders, or those needing regulatory protection.

👉 Join Axiom.trade now and unlock high-speed, on-chain trading — no KYC required.

📱 Platform Experience

-

Browser-based web terminal only

-

Fully compatible with Phantom, Backpack, Solflare wallets

-

No mobile app as of 2025

-

UX focused on data-rich, fast-action execution (similar to dYdX or Tensor)

🤔 Is Axiom.trade Regulated?

No. Axiom.trade is not regulated by any traditional financial authority like the FCA, CySEC, or FINMA.

While that makes it fast and permissionless, it also means:

-

No dispute resolution

-

No insurance on losses or exploits

-

No legal protection if funds are frozen

This is common among DeFi platforms, but traders should be aware of the risks.

🔍 Axiom.trade vs. Traditional Brokers

| Feature | Axiom.trade | Binance | dYdX |

|---|---|---|---|

| Custody | Non-custodial | Custodial | Non-custodial |

| KYC | No (mostly) | Yes | Yes |

| Perpetuals | Yes (50x) | Yes (100x) | Yes (20x) |

| Memecoin Sniping | Yes | No | No |

| Token Discovery Tools | Yes | Limited | No |

| Regulation | None | Yes (various) | Yes (SEC risk) |

❓ Frequently Asked Questions (FAQs)

Q: Can I lose funds on Axiom.trade?

A: Yes. Like any trading platform, especially DeFi-based ones, losses from slippage, failed trades, or volatility are possible — plus platform risk due to no regulation.

Q: Can I withdraw anytime?

A: In theory, yes — since it’s non-custodial. But user reports indicate there have been withdrawal delays and account issues.

Q: Is it anonymous?

A: Mostly. No KYC unless you hit specific account flags. Coinbase Pay may require ID, depending on volume.

👉 Join Axiom.trade now and unlock high-speed, on-chain trading — no KYC required.

Q: Is it beginner-friendly?

A: No. Tools and volatility are advanced — not recommended for new traders.

🏁 Final Verdict: Is Axiom.trade Worth Trying in 2025?

Axiom.trade is an ambitious, high-speed platform tailored to memecoin traders and DeFi-native users. Its toolset is among the best for discovering and sniping Solana-based tokens before the crowd.

But it comes with real risks:

-

No regulation

-

Poor user support history

-

Reports of fund access issues

-

High fees for low-volume traders

If you’re a confident, technically savvy trader — and you’re comfortable with full on-chain risk — Axiom.trade offers some of the most cutting-edge tools in the Solana ecosystem.

If not, safer, regulated platforms like Binance or OKX may be more appropriate.